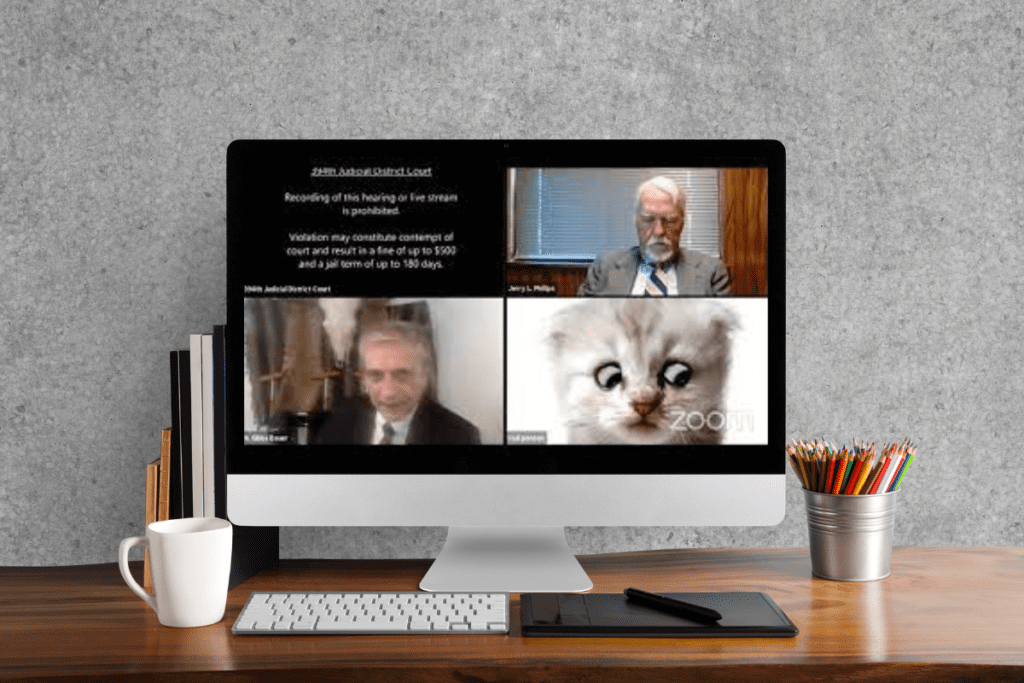

COVID-19 made 2020 the best of years for some, and the worst of years for others. Working remotely changed the way we think about and do business. There were opportunities seized and epic failures for others (like the Texan lawyer who famously couldn’t switch off the cat filter off his zoom court appearance).

And there was also a lot of doom and gloom in the property press. But has COVID-19 been a nail in the coffin of Australia’s property market? In a recent chat with Ticker HOME’s, Adrian Franklin, I got into the nitty gritty about property trends emerging in 2021. I explore that in more detail below.

6 trends out of COVID to shape best property investments

The viral cat-lawyer story actually says a lot about life trends post-COVID. How video conferencing is such a fact of life that even court hearings are happening virtually. How working parents have been sent home to share kitchen benches with their kids (who are putting cat filters on their Zooms.) It also illustrates how big the digital divide is between generations, i.e. between kids and their parents (who can’t get the cat filters off their Zooms).

As I told Ticker TV’s Adrian Franklin, while I don’t have said filter (no fear of me getting my kitten on), I do have the Oompa Loompa filter. It turns your eyebrows green, for the record.

But you’re not here for my eyebrows. I see 6 major property trends looming for 2021, starting with a now-familiar, three-letter acronym.

SCROLL DOWN for my top 6 post-COVID trends and how to spot one of the best property investments in 2021

1. Working from home (WFH) means a new kind of home

In June 2020, Roy Morgan told us there were 4.3 million Australians working remotely. A lot of those workers are still WFH. Many won’t be forced to go back to their workplace fulltime; nor do they want to.

According to a report commissioned by Indeed, 68% of employers offer a WFH policy. A survey of public transport users from September 2020 found that most wanted to continue working remotely about two days a week once the pandemic was over.

But something’s gotta give. The WFH experience has shown that the dining table or the desk in the master bedroom don’t cut it. A dedicated office space, ideally one that’s separate from the rest of the house, is now on a lot of people’s wishlists.

The home-office trend is being supported in some states by processes that allow you to do small renovations without development approval from council. In New South Wales for instance there’s an ‘exempt development’ where you can put a 10m2 studio in your backyard, as long as you use a qualified tradesperson and you meet the criteria.

All of these factors will change the way we build and renovate, and which make the best property investments.

2. Developing a different kind of work cover

If you’re working at home and you hurt yourself tripping over a laptop cable, how are you insured? What is your employer’s duty here? What kind of audits will we need around this? As Malcolm Sutton pointed out in his ABC News article, occupational health and safety has to be re-assessed in the new WFH environment.

The good news is if you’re using a dedicated space – whether an extra bedroom, a granny flat, backyard studio or a converted garage, you’ll potentially be simplifying that risk scenario. You’re also giving yourself some nice tax deductions – just make sure you check what the implications are for capital gains tax.

3. The emergence of the office home (as opposed to the home office)

The Property Council of Australia’s Office Market Report released in February 2021 says that office vacancy across the country increased from 9.6 per cent to 11.7 per cent in the six months to January (2021) — the biggest jump since January 1997. Note: it’s a regional trend, not just in CBDs.

With millions of people in WFH mode at least part of the time, and businesses stuck with long leases on their premises, we need to reimagine commercial square meterage. One solution I think is smart, is to build a big boardroom with facilities, as well as key offices for say 3 to 5 staff who are integral to running the business. Each office would then have a one-bedroom apartment, (kitchen and bathroom included), attached through a connecting door.

How that might play out is, once a month, all staff gather in the boardroom. But 24/7, those 3 to 5 key personnel have close proximity to the office, potentially paying a low rent, with utilities thrown in. That’s their opportunity to save some money and buy their own property in 3 to 5 years. It’s a co-housing solution that gets my stamp of approval.

What are the best property investments? Scroll down to find out more!

4. Mass migration to our beautiful regions

If you only have to commute once or twice a week, or once a fortnight – or never, then having to live within a 45-minute drive of your office is no longer a consideration. Nor is being on a train line. So people aren’t clustering their living according to where they work like they used to.

In the three months to the end of September 2020, 11,200 people left the big smoke for regional Australia, primarily one to two hours away from major metro areas. And it’s a trend that I believe will continue. Our regional cities and towns have been undervalued for the last 20 years and now they’re playing catch-up.

The obvious benefit is that people can buy more cheaply. Of course, this growing movement has increased competition for buyers in regional areas so they don’t make the best property investments. But there are many benefits to balance that out: from a more relaxed lifestyle, to the community feel you enjoy in smaller centres.

I know myself, after moving out of Sydney 10 years ago, how transformative that has been for my family and me, to live on two acres and be 15 minutes from the beach.

5. Moving interstate for the win

Nationally, we’ve had 76,200 people move interstate in the three months to the end of September 2020. That’s the lowest number for that quarter since 2014, thanks to COVID.

Queensland is the frontrunner with a net migration of 7,237 people. Victoria lost 3,749 people, and more than 4,000 departed New South Wales.

While it’s traditionally been sea/tree-changes inspiring such moves, now it’s business shutdowns and border insecurity. People are watching what’s happening around the country and it’s creating a fear around being stuck far from your family, or your market. Another strong motivator is the likelihood that your business might be closed multiple times, as in the Victorian experience.

These are decisions that might have taken years otherwise. Where someone might have previously thought, “We’ll just live here for 10 years more and then we’ll go to the sunshine,” now they’re saying, “You know what? I’ve had enough of the uncertainty and the closures. Let’s move right now.” So they’re picking up their lives, their families and their businesses and going interstate.

Will property prices rise in 2021 and beyond? If you’re looking to find information on the best property investments moving forward, scroll to the bottom to find out!

6. Property prices on the rise

In the heat of COVID, there was wholesale doom and gloom around property prices. CBA released modelling showing house prices could fall by almost a third by the end of 2022.

How has that panned out in reality? Metropolitan areas are going gang busters. As of the December quarter 2020, we’ve hit the highest-ever median house prices across most metropolitan cities. Sydney is well above $1.2 million, Melbourne is above $900,000 and Brisbane, that so-called big country town, is over $700,000.

As at February 2021, CBA is now forecasting an 8% rise in house prices in 2021. Doom and gloom? Vanished.

In Southeast Queensland, we’re down to 40 days on the market for listings; there are areas like the Sunshine Coast reacting very strongly. (I wouldn’t necessarily recommend you buy in this market of uncontrolled growth – hot spots are overrated.

Not one to blow my own trumpet (well, not all that often) – I always believed there would be an upswing. Now, with lending made easier and the onus back on borrowers to ensure they can meet their repayments, we’ll see the market super stimulated again.

Never fear, despite being occasionally distracted by cat-lawyers, my focus is always on affordable housing. With people continually being priced out of hot markets, it just adds more fuel to our mission: to change the housing landscape in Australia one co-living, cashflow-positive property at a time. Keep reading my blog for more advice on best property investments.

FIND OUT MORE: Join my Positive Cash Flow Webinar to learn the high income property strategy that can yield high returns in 2021 ands take advantage of the post-COVID property market HERE!