Prices are going up, and savings are going down! Is getting into property as possible as hell freezing over? With a little savings, here’s how to invest in property with no money (almost).

Each week you’re shelling out a big chunk of your paycheck on your rent or mortgage, and a pretty bleak savings account doesn’t put you in a high position to get a loan (and service it) or even to be able to partner with someone on a deal.

So, what should you do to get ahead when the other options of investment like stocks, bonds, and the money market can be a volatile choice, and you can risk losing your precious investment overnight?

Well, the great news is that there is a way that you can invest in property with low funds and low risk. The best thing about this strategy is that you can get a rental income from a property you don’t even own.

When people first hear about this strategy, they often don’t immediately get the concept. There are a few things which may not make a lot of sense yet, but if you bear with me, I will give you a short introduction.

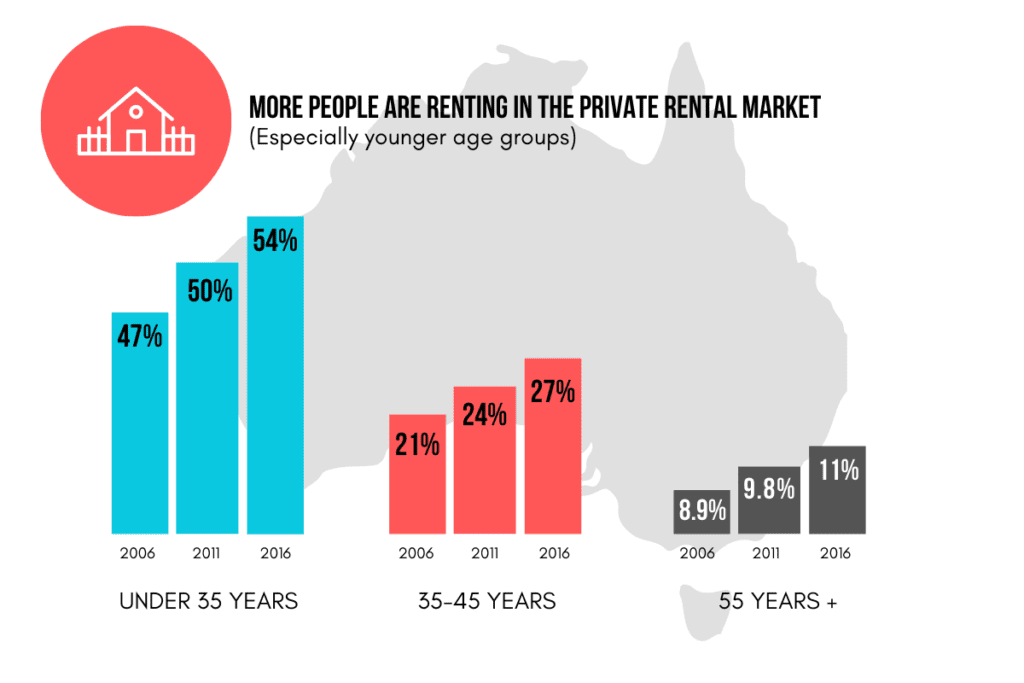

But first, to understand the reasoning behind the strategy and why it works, you need to know a bit about the rental market, what is available, and the type of people out there looking.

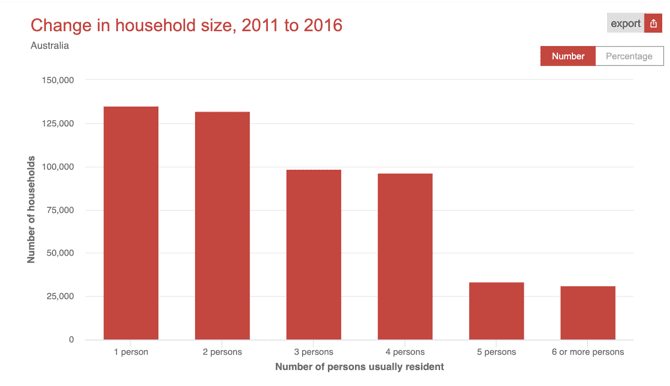

Australia’s last census showed that the most significant change in household sizes was single-person (+134,971), and two-person (+132,147) households.

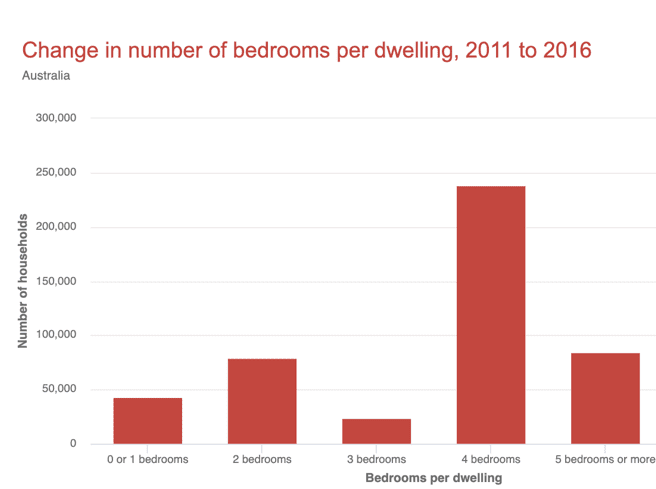

But when you look at the next graph, you can see at the same time; it was four-bedroom houses that had the most significant growth.

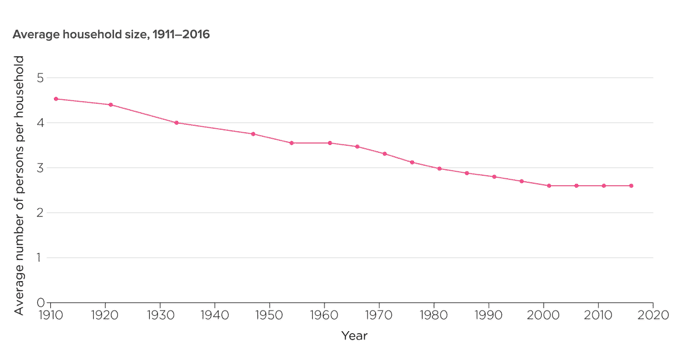

What is happening to all those houses when the average household size is only 2.6?

This is a situation found right around the country, and it’s what I always refer to as the ‘Upside down Marketplace.’

SCROLL DOWN to learn how to invest in property with no money (almost)

In short, our 4, 5, and 6 bedroom houses are just too big for the market. And we have millions of them. There are 12 Million bedrooms in Australia that are unused.

What if you could take advantage of those empty rooms and get yourself into a comfortable financial position to be a property investor?

Enter, the “Rentrepreneur” Strategy

Our ‘Rentrepreneur’ Strategy” is the most innovative and modern strategy that people can use.

We named it that because it’s partly an entrepreneurial skill and partly a rental that you’re going to access, that isn’t your property.

In what way does this work?.

First, do your research to find the right property.

After you’ve done that, contact the agent or owner renting out a suitable property.

When you approach the landlord or agent, explain how you will create a structure to rent that property and then seek approval to convert it into micro-apartments for multiple residents. With this structure in place, you will profit from the higher rent you’ll receive from your tenants.

You may be asking now, “Why would you go to an agent or a property investor who is renting out a property, rent it, and then spend money converting it, knowing that you might not get that money back?”

How much is too much rent to pay? FIND OUT HERE

Well, that seems like a logical question to ask!

Firstly, I will stress that none of our clients ever spend anything on a property until they know that it will return positive cash flow.

The second part of the process is to test the market. Our clients have access to our standard proforma market test to see if there’s demand.

If you can’t get your money back in the first year, then I wouldn’t be doing the deal.

Some of our clients are already in an eight-month period where they get their investment back. They won’t even look at doing a deal unless they can get back their original spend in those first eight months.

That’s why thorough feasibility is an essential part of this process. You’ll need to determine whether the property is in a location with enough demand and result in the desired return. Most importantly, your feasibility will determine how quickly you could get your money back from your start-up funds.

With this strategy, a common obstacle you’ll encounter is the real estate agent who may tell you emphatically that they don’t ever work with this type of scenario because they don’t believe it’s legal.

We do everything in full compliance with council and state regulations. And we provide you with documentation to implement the structure in your state and locale. The document that you can give to the real estate agent or property owner sets out the advantages of renting to someone using the rentrepreneur strategy.

The first advantage for agents or owners is that you’ll be upgrading the fire and safety requirements at your own cost to protect the inhabitants within the building. In some parts of the country, the legislation is already in place, and in other parts of the country, it will be coming soon. So you’ll be helping the owner meet these requirements at your cost.

For example, every investment property in Queensland has to have these increased fire and safety standards by 2022. For a property investor renting out a property to the standard market, having these installed, would cost around $2,000 to $3,000.

The next benefit is that we offer owners a three-year lease, implemented in increments. With that lease in place, the owner will have the peace of mind of zero vacancies over the next three years. That assurance of income is of significant advantage.

If the agent is still not over the line, you may offer to increase the rent and pay them a little more.

There is also an extra benefit of a higher level of insurance cover. The owner will need to have insurance, but because you will be using the ‘Rentrepreneur’ strategy, you also have to be insured.

Our insurer will look at the owner’s policies, and we can most probably get the same insurance level for less money. Not only will there be double the insurance, but the owner will also benefit from a cost-saving.

The advantages to you as the Rentrepreneur

There are many advantages for property owners, but what about the benefits to you as someone wanting to know how to invest in property with no money (almost)?

Firstly, if you use the ‘Rentrepreneur Strategy’ on properties where you know you will have the opportunity to purchase down the track, it gives you a foot in the door. The owner’s first call when they want to sell will be to their agent, and the next call will be to you, allowing you to purchase off-market and potentially save money on the purchase price.

You won’t be shelling out for on-going costs.

The other great advantage is that if you don’t own the property, you don’t have to pay any rates. You also don’t have to pay any interest, and you don’t have to pay for certain parts of the insurance.

There is a whole list of things that you don’t have to pay for because it’s the owner’s responsibility to cover them.

Another fabulous benefit to you is that if anything ever breaks down, it needs to be fixed by the owner because it is a maintenance requirement.

That means that if there needs to be a new stove put in, or new hot water service, or anything that is required to upgrade the property because something’s broken, you’re free from having to pay

There are other advantages to not owning the property.

If you were the owner of an investment property and your loan amount is million dollars, just on interest costs alone, you would be paying about $50,000 per year.

That’s a thousand dollars a week!

Let’s say that the owner is renting out a property for $500 to $600 a week, maybe $700 a week. Just on the interest payments alone, they are already behind $15,000 a year, as well; they have the added costs of rates, the maintenance expenses, and replacement costs.

To give you an example of this scenario, one of our clients is renting a property worth $2,000,000.

They pay $700 a week rent, and they receive well over $1,700 a week.

This is a case of how to invest in property with no money and see a return of having $40 to $50,000 extra cash flow for every year on someone else’s property.

So why wouldn’t the owner do this themselves?

The simple answer to why owners don’t do it themselves is because they don’t know how to do it.

We are currently using the ‘Rentrepreneur’ Strategy’ on a property in Western Australia, which was already half set up – meaning that it was partially furnished.

The problem was that the owners didn’t have the necessary fire and safety requirements. In this case, someone thought that they could do what we do without having any knowledge.

The fines for not doing things the right way are enormous, including jail time, which is why you need to know these rules and regulations and put them in place.

So, we took over that property, offered them a long-term lease at an above-market rate, and of course, they were happy.

They no longer had, what they called, a headache. We took over and upgraded the fire and safety requirements and put the rest of the furniture in.

So if you’re someone who can’t afford to purchase a property and looking for how to invest in property with no money, this is the perfect scenario.

In this situation, you could easily borrow the $5,200 amount paid to set it up. Having the fire and safety means that it’s now set up and running, and everyone’s enjoying the benefits of a win-win situation.

Another great thing that often happens is that when you hand the property back at the end of the term, they come back to you after maybe three, five, or six months and ask if you are interested in retaking the property.

Why can we make it work, and they can’t?

The reason we can make it work is that we have specialist agents around the country that look after these styles of properties.

They are specialists, who may charge slightly more to look after your property. Still, it’s not excessive, especially considering that your rental return is doubled and tripled compared to a standard rental.

There are significant advantages for the residents too

If we take an area where the median rent for a four-bedroom house is $420, but for a two-bedroom house, it’s $415.

We can see that there’s not much difference in the rental price between a four-bedroom and two-bedroom property.

This particular four-bedroom is not what most singles (or couples for that matter) want or can afford.

In a report of that particular area, 96% of people were living under housing stress.

Using the policies that are available around the country and creating small self-contained areas that share one other space, not only are you addressing the demand for affordable housing, but you can get a much better return for your money.

If you were renting out that property, you could offer those areas for $200 to $250. In this household, you can get a rental return of $800 plus per week instead of only $420 that the standard investor will get.

So, the distinct advantage for those living in these properties is that they are getting much cheaper rent.

Rather than paying the $420 in rent, they’re paying half that.

They have the bonus of only having a small portion of the property to look after, and with their utilities included, they are saving even more.

All of these advantages allow tenants to put money aside to invest in property themselves.

So, the ‘Rentrepreneur’ Strategy’ is undoubtedly an easy way to get into the game if you want to invest in property with no money or significant savings behind you.

The example I have given where you can get into this for $5,207, is to prove that it can be done.

On average, setting one of these up will cost you somewhere between $10,000 to $15,000. For that amount, you should be able to make $10,000 to $15,000 back per year.

You can start with one property, spend around $15,000 on it and end up with $120,000 in income within four years – just by renting out a property.

It’s the answer to how to invest in a property with no money down, and by merely renting out a property, you can generate the funds for a deposit to get into your first home. This strategy is the most fantastic opportunity to get started in the property market in many years.

Learn more by joining my Positive Cash Flow Webinar HERE.